OpenStar Technologies’ seed investors, led by Outset Ventures, have compared its potential with Rocket Lab.

OpenStar Technologies has emerged from stealth mode after closing a US$6.2 million ($10m) seed round led by Outset Ventures and supported by Icehouse Ventures, Blackbird, Radar, Ngāi Tahu Holdings, K1W1, and Aspire.

NBR reported in March on the existence of OpenStar as one of Rod Drury’s Radar Ventures’ first investments, although those involved with the business were keeping tight-lipped about its proposition at the time.

Now OpenStar has let the sun shine on its venture, releasing a statement today explaining its not-insignificant mission of harnessing fusion to revolutionise global energy supplies, as led by co-founder and CEO Dr Ratu Mataira – a Robinson Research Institute alumni.

The startup had “quietly” opened the doors at its Ngauranga facility a year ago, and has since recruited 28 “hyper-specialised” staff to build “one of the boldest engineering prototypes New Zealand has seen,” it said today.

By the end of this year, it aims to have used its prototype technology to surpass other researchers “with half the money, in a fifth of the time”.

Outset Ventures partner Angus Blair has called OpenStar “undoubtedly the most ambitious startup to come out of New Zealand”, while Icehouse Ventures’ Robbie Paul put the company in the same world-beating category as Rocket Lab, in terms of commercialising an area typically dominated by governments.

According to the Companies Office, Open Star Technologies is 62.7% owned by Mataira, 23.08% by Icehouse Ventures, 9.51% by Blackbird, 2.35% byAspire NZ Seed Fund, 1.59% by Radar Ventures, 0.48% by Ngai Tahu New Economy, and 0.29% by an Open Star employee share option plan.

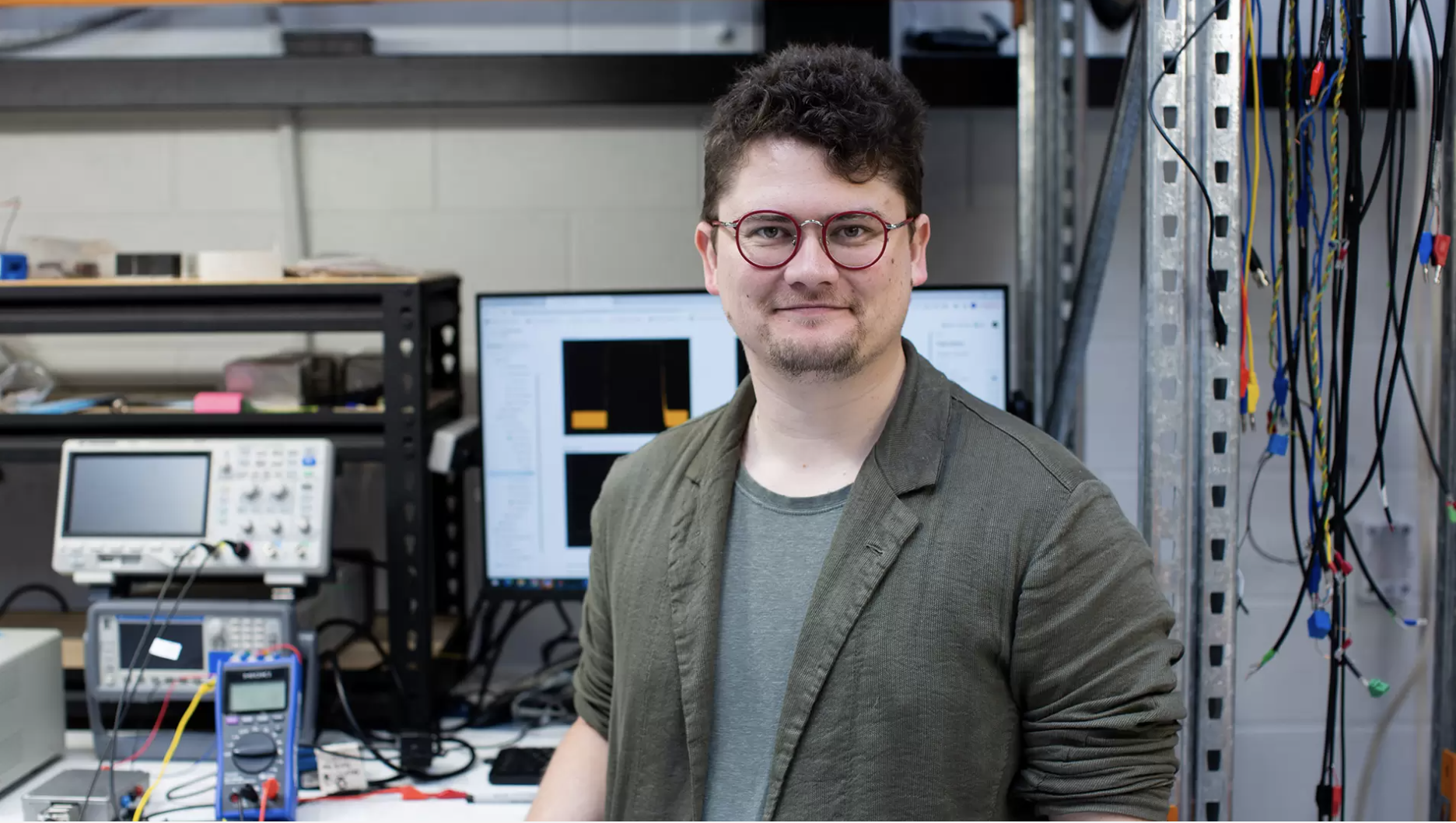

OpenStar Technologies co-founder and CEO Dr Ratu Mataira.

Con-fusion?

Fusion involves the merging of light atomic nuclei – such as the isotopes of hydrogen – to make new, heavier elements and thereby produce the kind of energy we see emerging from the sun and other stars.

Fusion has been a key field of research for years, to help humanity unlock an efficient and effective energy source, and while New Zealand scientists and the Robinson Research Institute have played a huge part over the years, Mataira’s particular approach is giving fresh hope of a breakthrough.

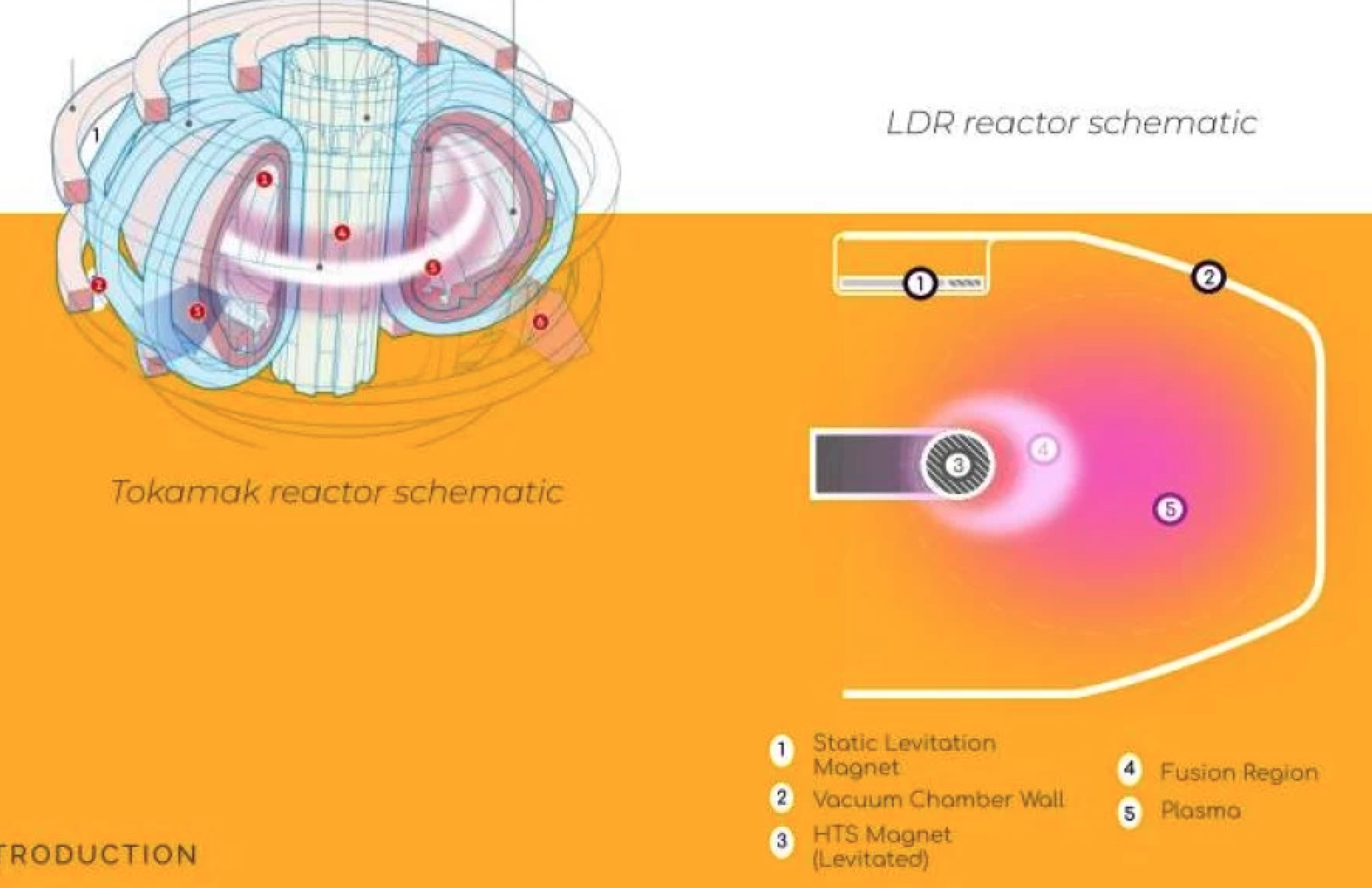

OpenStar’s point of difference to other fusion companies is in the design of its reactor.

It is revisiting the ‘Levitated Dipole Reactor’ (LDR) design that was originally pioneered by MIT and Columbia University in the early 2000s, although the ‘tokamak’ technique has been the mainstream approach in recent years.

Mataira reckoned the LDR posed the best possible path to achieving limitless energy.

A tokamak uses magnets to confine a donut shaped plasma in their centre, whereas the LDR positions its superconducting magnets in a donut shape, which confines plasma around the magnets.

The LDR geometry gives it a host of benefits from a plasma physics perspective, which presented an enormous competitive advantage over the mainstream approach taken by other private fusion companies, according to OpenStar.

“If not for a chance conversation with a friend in 2020, the Levitated Dipole Experiment may have easily been lost to history,” Mataira said. “I looked at the development of technologies such as the high temperature superconductors (HTS) and realised that these solved a number of thekey issues that dogged the original approach.”

Schematics showing the respective designs of tokamak and levitated dipole reactors.

Capital intensive

According to the Fusion Industry Association, there are 35 publicly active, privately funded fusion energy companies around the world, OpenStar noted. The ‘leader’ – Commonwealth Fusion Systems – has raised more than US$2 billion, and there are six others that have attracted more thanUS$200m, the company said.

In an information document alongside today’s announcement, under the heading Impact to New Zealand, OpenStar noted that its strategy was “highly likely to retire risk far quicker and far cheaper than our competitors.

“That being said, in a New Zealand context, the capital intensity of this business is unprecedented in the private sector.

“OpenStar’s seed round was roughly US$6.2m, which is being deployed on an 18-month timeline.

“Looking ahead towards the Series A capital raise and beyond, OpenStar will be deploying hundreds of millions, or possibly billions of dollars of capital throughout this decade. It is OpenStar’s expectation that it will become an international business at some stage on this timescale.

OpenStar’s team at its facility near Wellington.

“While many look at the success of Rocket Lab as being the beginning of an NZ space industry, it is actually a wider effect, of which OpenStar isanother leap. The New Zealand tech ecosystem is maturing!”

Mataira credited his whakapapa with his single-minded quest for OpenStar. His grandmother, Dame Kāterina Mataira, received her knighthood forher efforts to save te reo Māori from extinction.

“If she could do that, what is the measure of what you can do in a single life? For our generation – for my life – that challenge is climate change and the future of human prosperity,” said Mataira.

“Fusion itself is only a technical solution, but these problems are more than technical. Saving te reo Māori wasn’t done via an app, AI, orgovernment intervention – it was done by people coming together with a sense of responsibility, courage, and hope to protect what was most important to them. That’s OpenStar, and that’s me.”

Will Mace

Mon, 07 Aug 2023